Finance and its related matters are the most important part of a business, as the whole point is to make money. Therefore, it shows important business activities and overall financial performance of a business or company. Furthermore, these statements are very important and used for public assessment of the company. As a result, it is mostly handled by external bodies and agencies to ensure accuracy and for taxation reasons. Read on to find out everything you should know about financial statements.

What are financial statements?

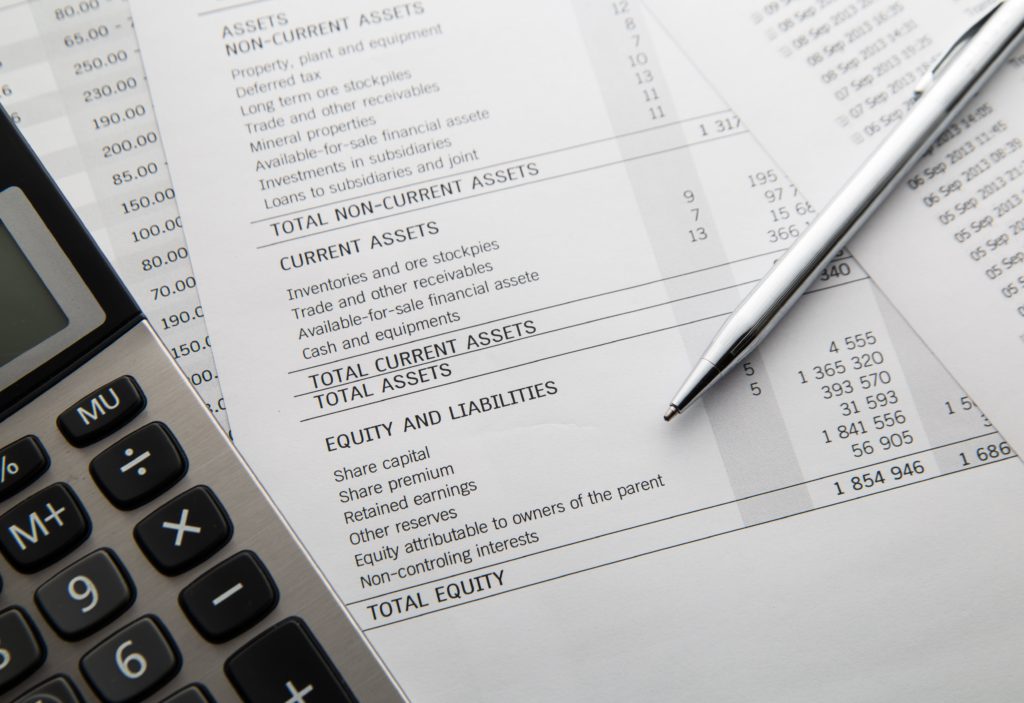

Financial statements are simply records that show the financial performance of a specific company or institution. Also, some details included in a financial statement include; income statement, balance sheet, and cash flow statement. In essence, these statements, and more, come together to show what is going on financially in the company.

One of the key importance of financial statements is that it helps investors analyze the current and future performance of a company. Therefore, with the financial statement, they can predict how well it’d do in the future. Also, it helps in estimating a company’s’ stock price. The financial statement is always released either monthly, quarterly, or annually, depending on the laws of the company. Due to its usefulness, the law does not permit companies to audit themselves or draw up their financial statements.

What are the major basic financial statements?

The six basic financial statements of business include:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

- Gains

- Losses

- Investment from owners

- Finance distribution to owners

- Comprehensive income

What items are included in the financial statement balance sheet?

A balance sheet usually contains the following:

Assets:

This includes cash and cash equivalents, as well as other accounts receivables of the company. Also, money owed to the company is to the added, as well as items it possesses in its inventory.

Liabilities:

liabilities include debt, dividends payable, and wages of staffs and contractors.

Shareholders’ equity:

this figure is estimated by a subtracting a company’s total assets from its liabilities. Therefore, the value represents the amount of money that the company would pay to shareholders if all its assets were liquidated and debt paid off. Also, it includes retained earnings, which takes into account the net earnings that the company has not paid to shareholders as dividends.

How do I prepare financial statements?

Calculating a financial statement could be very simple or complex depending on the business and its amount of resources. However, you can simply follow the steps below to successfully prepare your financial statements:

Pick a reporting period:

this entails simply choosing how often your company would release a financial statement. Therefore, as earlier said, it could be on a monthly, quarterly or annual basis. However, some laws in certain areas mandate companies to make use of certain reporting period.

Generate a trial balance report:

the trial balance report is simply a document that contains useful account reports for a specific period. In addition, you can easily generate this by using your company’s accounting software.

Calculate your revenue:

this is pretty straightforward. The next step is to calculate the total revenue of the company within your chosen reporting period. Therefore, it includes all money earned, and payments yet to be received.

Determine the cost of goods or services sold:

this includes materials, labour and other expenses the company spent in providing their services. Also, they usually list the cost of goods sold on the income statement below the revenue list.

Calculate the gross margin:

next up, calculate the gross margin. Furthermore, you can easily do this by subtracting the total cost of goods sold from the total revenue on the income statement.

Include operating expenses:

operating expenses simply takes into account every penny spent on operation. In reality, it should exist in your income statement.

Calculate your income:

they call this value the pretax income. You can calculate it by subtracting your expenses from your total gross margin. Also, you should enter the total value at the bottom of your income statement.

Add income taxes:

you can easily estimate your income tax by multiplying your specific tax rate by your pre income tax amount. Also, this determines how much you would pay as a tax.

Evaluate your net income:

Net income is simply income tax minus pretax income. Also, note that you are to record the amount on the final line of your income statement.

Crosscheck the sheet for errors:

lastly, financial statements require that you play with a lot of numbers and documents. Therefore, it is important that you crosscheck your work before passing it on as final. A single mistake could be very costly.

Conclusion

Financial statements are practically the success determination of a company. Therefore, investors, other public individuals and institutions make use of it to access a company. In all, it shows how well or poorly a company is doing, therefore, shedding light on its future potentials.