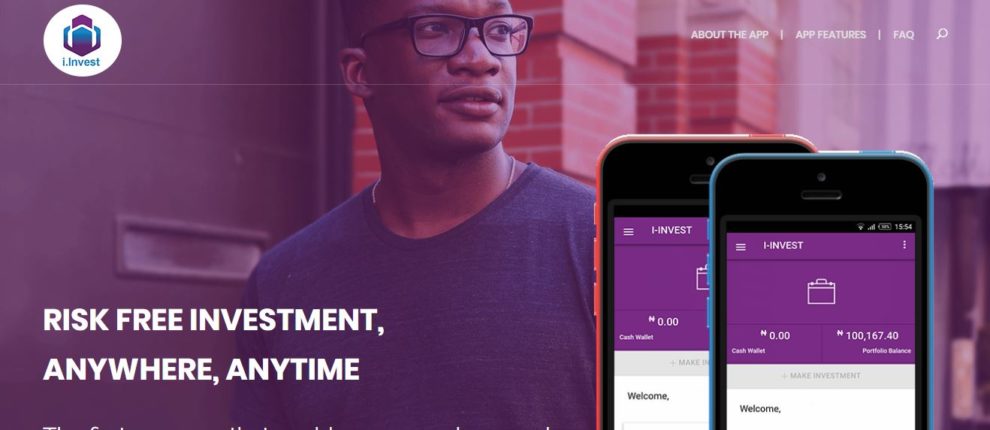

It is no longer news that investment is the pathway to financial freedom. Therefore, if you are looking to amass great wealth, investment is key. I-invest is a mobile application that encourages people to cultivate an investment culture. It is a secure, convenient, and fast means to access several investment options. Are you interested in investing in your capital? Look no further. We have put this article together to provide you with all you need to know about I-invest. This includes how to invest with them, the perks and benefits amongst several others.

About i-invest

I-invest belongs to Parthian partners limited. It is an organization regulated by the SEC (security and exchange commission. The i-invest is a mobile application design to help rookies and old hand investors buy securities and other instruments without the help of a broker.

Read more about mobile money operators in Nigeria

Furthermore, I-invest provides its users with a User Interface dashboard that allows you to monitor all your portfolios. In addition, it is also a safe way for retail investors to save their funds and also earn juicy interest rates. This also enables them to help fund infrastructure projects in the Nation while also earning an income.

How do I register with I-invest?

Registration on I-invest mobile app. should take you anywhere around 5 minutes. To register you must have your Bank Verification Number (BVN) and an excellent internet connection. In addition to this, they will also require you to fill an application form with details such as your name, email address, phone number.

I-invest product offerings?

I-investment allows you to invest in several instruments. Some of these investment options include :.

- Treasury Bills:

T bills as people often call them are a short-term debt instrument allocated by the Federal Government through the Central Bank. This is to serve as a means of short-term funding to the government.

- Eurobonds:

This is an investment issued in a currency that is not native to your home country. It is granted by the Government and International Organizations.

- Equity:

This investment option allows you to invest by buying and selling shares in the publicly listed company in the stock market.

How do I invest with i-invest?

Investing in I-invest is very direct and straightforward. All you need to do is pick from the list of investment options. This generally includes the Treasury bill, Eurobonds, and equities. After you must have done this, enter your desired amount of investment. The minimum you can invest for the Treasury bill is #50,000 and the naira equivalent of $1000 for Eurobonds.

To invest you can credit your wallet using either a debit card, bank transfer, mobile banking app or by visiting a bank branch. However, if you are visiting a bank branch, you would need to provide your unique Id for them to fund your account.

What are the benefits of investing with I-invest?

- Security:

I-invest ensures that they protect all investments in safe custody. They make this possible by the Securities and Exchange Commission. Therefore, you can b of maximum protection for your capital.

- Easy Access:

Irrespective of who you are, or who you used to invest with, i-invest product offerings are available for all and sundry.

- Easy Withdrawal:

Withdrawing your investment never got so easy. With i-invest, we can assure you of a smooth withdrawal process. Enter your bank and the amount you wish to withdraw. In no time, they would credit your funds into your bank account.

I-invest mobile application

I-invest is the first-ever mobile application that allows investors to securely and conveniently buy and manage Eurobonds, treasury bills, and equities. The mobile application is available for download on Google play store and the App Store. Download the application, register, fund your wallet, and start investing in ant product option of your choice.

Check out how to use access bank mobile apps

How do I withdraw my money?

Withdrawing your returns on the I-invest platform is very easy, all you have to do is:

- Provide your bank details

- Enter the amount you wish to withdraw

- Provide the answer to the secret question you inputted during registration.

- In no time, they will credit your bank account.

It is important to note that your profile and KYC must your profile, and you must update KYC before they can allow you to make withdrawals. You can only make withdrawals to the bank account linked to your BVN.

How do I contact I-invest?

If you have any inquiries or wish to report any issue, you can contact I-invest via any of the following channels.

- Mobile Number: +23419037095, or +234 8075290008

- Email Address: info@i-investng.com or enquiries@i-investng.com

Conclusion

If you are looking to invest in risk-free instruments such as the Eurobond or Treasury bills, I-invest is your go-to investment provider. They exist to connect millions of investors to opportunities. Invest with them today by choosing any of their product offerings and be glad you did.